The 3-Minute Rule for Paul B Insurance Medicare Explained

Wiki Article

What Does Paul B Insurance Medicare Explained Do?

Table of ContentsPaul B Insurance Medicare Explained for DummiesHow Paul B Insurance Medicare Explained can Save You Time, Stress, and Money.How Paul B Insurance Medicare Explained can Save You Time, Stress, and Money.The Definitive Guide for Paul B Insurance Medicare ExplainedAll about Paul B Insurance Medicare ExplainedAbout Paul B Insurance Medicare Explained

Depending on your income, you and your family might certify for cost-free or low-cost health insurance policy via the Kid's Health and wellness Insurance coverage Program (CHIP)or Medicaid. Medical Assistance gives thorough insurance coverage as well as is there for people who drop on tough times as well as require assistance.If you are entitled to elect COBRA coverage, you must be offered an election duration at any moment for up to 60 days after the national emergency statement is lifted for COVID-19 (paul b insurance medicare explained). If you pick to proceed your COBRA medical insurance plan at your very own cost, you will additionally pay the part of the costs your previous employer paid in your place.

You have options when you buy medical insurance. If you're purchasing from your state's Market or from an insurance coverage broker, you'll select from health insurance arranged by the degree of benefits they use: bronze, silver, gold, as well as platinum. Bronze plans have the least protection, as well as platinum plans have one of the most.

Facts About Paul B Insurance Medicare Explained Uncovered

How are the strategies different? Each one pays a collection share of expenses for the average enlisted person. The details can differ across strategies. Additionally, deductibles-- the amount you pay prior to your plan grabs 100% of your health care prices-- vary according to plan, usually with the least costly carrying the highest insurance deductible.Catastrophic plans have to likewise cover the initial three health care visits as well as preventive take care of free, even if you have actually not yet met your insurance deductible. You will certainly also see insurance policy brands related to the care levels. Some huge national brand names include Aetna, Blue Cross Blue Shield, Cigna, Humana, Kaiser, and also United.

Being familiar with the strategy kinds can aid you select one to fit your spending plan as well as satisfy your healthcare requirements. To find out the specifics about a brand's certain health insurance plan, check out its recap of benefits. An HMO delivers all health and wellness solutions via a network of healthcare service providers as well as centers.

If you see a doctor that is not in the network, you'll might have to pay the complete costs yourself. Emergency situation solutions at an out-of-network healthcare facility have to be covered at in-network rates, yet non-participating doctors that treat you in the hospital can bill you.

Facts About Paul B Insurance Medicare Explained Revealed

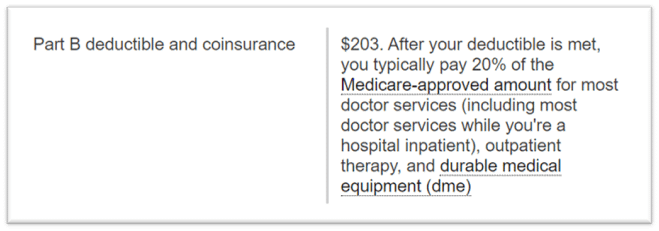

Insurance deductible: Your strategy might need you to pay the amount before it covers care with the exception of preventive care. Copays and/or co-insurance for each and every sort of care. A copay is a flat fee, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the costs for treatment, for instance 20%.

Documents entailed. There are no claim develops to fill in. With a PPO, you may have: A modest quantity of liberty to pick your health care service providers-- more than an HMO; you do not need to obtain a referral from look at here now a health care doctor to see an expert. Greater out-of-pocket prices if you see out-of-network medical professionals vs.

Various other expenses: If your out-of-network physician charges even more than others in the location do, you may have to pay the balance after your insurance policy pays its share. If you make use of an out-of-network supplier, you'll have to pay the supplier.

With an EPO, you may have: A moderate quantity of flexibility to choose your health treatment companies-- greater than an HMO; you do not need to obtain a recommendation from a medical care physician to see a specialist. No insurance coverage for out-of-network companies; if you see a carrier that is not in your strategy's network other than in an emergency situation you will certainly need to pay the full cost on your own.

The Facts About Paul B Insurance Medicare Explained Revealed

Any in the EPO's network; there is no protection for out-of-network companies. Costs: This is the cost you pay monthly for insurance. Deductible: Some EPOs might have an insurance deductible. Copay or coinsurance: A copay is a flat charge, such as $15, that you pay when you obtain treatment. Coinsurance is when you pay a percent of the charges for treatment, for instance 20% - paul b insurance medicare explained.

You can see out-of-network doctors, yet you'll pay more. Costs: This is the expense you pay each month for insurance policy. Insurance deductible: Your plan might require you to pay the quantity of a deductible prior to it covers care past precautionary services. You might pay a higher insurance deductible if you see an out-of-network company.

You submit a case to your POS plan to pay you back. If you are under the age of 30 you can buy a catastrophic health and wellness plan.

9 Simple Techniques For Paul B Insurance Medicare Explained

Other costs: If your out-of-network doctor charges more than others in the area do, you may have to pay the balance after your insurance pays its share. If you utilize an out-of-network company, you'll have to pay the company.With an EPO, you may have: A modest quantity of freedom to pick your healthcare providers-- greater than an HMO; you do not need to obtain a recommendation from this page a health care doctor to see a professional. No insurance coverage for out-of-network suppliers; if you see a provider that is not in your strategy's network besides in an emergency you will need to pay the full cost on your own.

Premium: This is the cost you pay each month for insurance policy. Copay or coinsurance: A copay is a level fee, such as $15, that you pay when you obtain care.

A POS plan mixes features of an HMO with a PPO. With POS plan, you might have: Even more freedom to select your wellness care carriers than you would in an HMOA moderate quantity of documentation if you see out-of-network companies, A main treatment doctor who collaborates your treatment and also who refers you to experts, What medical professionals you can see.

All about Paul B Insurance Medicare Explained

Premium: This is the price you pay each month for insurance policy. Insurance deductible: Your strategy might need you to pay the quantity of a deductible before it covers treatment past precautionary services.Copayments and also coinsurance are greater when you utilize an out-of-network doctor. Paperwork entailed. If you go out-of-network, you need to pay your medical bill. After that you submit a claim to your POS strategy to pay you back. If you are under the age of 30 you can acquire a tragic health insurance plan.

Report this wiki page